It’s almost that time, when everyone resolves to do better and achieve more in the coming year. And a new survey suggests that some people may be fueling their 2024 resolutions with the financial regrets of 2023.

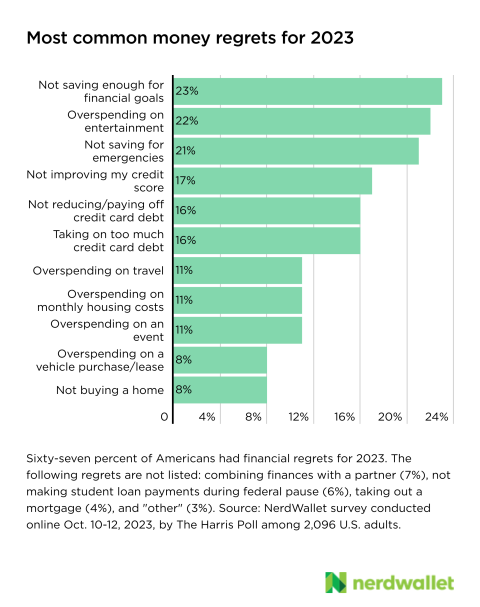

About two-thirds (67%) of Americans have financial regrets for 2023, according to a NerdWallet survey conducted online by The Harris Poll on Oct. 10-12. And three-fourths (75%) of that group say those regrets will lead to new resolutions in 2024.

Every year we face obstacles to our money goals. We may start out with plans to save more and spend less, but life happens. This year began with expenses taking bigger bites out of paychecks, in the form of high inflation. And as the year progressed, increasingly high interest rates added costs to credit card balances and loans, making it more expensive to borrow. Macroeconomic factors like these can be enough to derail financial goals alone, but if they’re paired with job loss, unexpected expenses or other household circumstances, they can push goals further and further out of reach.

If you have financial regrets, you’re in good company. And if your hope is to turn them into successes in 2024, plenty of other Americans have the same plan. Here’s how some of those regrets may have come about and what to expect in the year ahead.

Money regret No. 1: Not saving more

Nearly one-fourth (23%) of Americans regret not saving enough for their financial goals in 2023, according to the NerdWallet survey. And about one in five (21%) regret not saving for emergencies.

Government relief payments paired with constrained spending during COVID shutdowns to bring the personal saving rate to all-time highs in 2020 and 2021. In 2023, that rate, which measures the percentage of disposable income that can be saved, on average, settled below historic averages, making it more difficult to save for big purchases or unexpected emergencies.

In 2024: The personal saving rate, as a national average, is likely to stay on the low side. However, with inflation continuing to come down, you may find it easier to set aside funds in 2024 than you did in 2023. If you don’t have an emergency fund, start there — having a cushion set aside for unexpected expenses can insulate many of your other financial objectives. Then, set measurable and specific benchmarks — such as setting aside a certain portion of every paycheck — to get you toward your longer-term savings goals.

Money regret No. 2: Overspending

More than one in five (22%) Americans regret overspending on entertainment in 2023; 11% regret overspending on travel and 11% regret overspending on a big event (such as a wedding or party), according to the survey.

Consumer spending in 2023 has been surprisingly resilient in the face of inflation and high interest rates. This consumer resilience has been credited with keeping the economy strong when many expected a recession. But there is also evidence that this spending in the face of adversity has been achieved by busting household budgets.

In 2024: Overspending is a risk every year — it’s hard not to splurge on things like entertainment, travel and parties (we all enjoy a good time). The first step to reining in these urges, however, is setting a clear budget. Whether it’s a weekly entertainment budget or a wedding budget, setting a clear expectation for yourself beforehand can help ensure you’re not left with remorse when the dust settles.

Money regret No. 3: Mismanaging credit card debt

Equal shares of Americans (16%) regret not reducing/or paying off their credit card debt and taking on too much credit card debt in 2023, according to the survey.

Credit card debt levels fell during 2020 and early 2021, as people had excess money thanks to relief payments and student loan forbearance, for example, and were generally spending less due to COVID lockdowns. But since then, debt levels have been surpassing pre-pandemic normal. If you used your cards less in 2021 and even paid off some debt, this return to “normal” can feel especially bad.

In 2024: When your finances are in good shape, using credit cards as a tool — to earn points and cash back, for instance — can help you reach money goals more quickly. However, when you’re in debt or have to turn to a credit card to cover an emergency expense, the interest can pile up quickly and make it difficult to dig yourself out. Interest rates will likely remain high throughout 2024, so getting those balances under control is even more important. Make a concrete debt payoff plan, and if you’re struggling to make payments, consider debt relief options such as consolidation and debt management.

Lest 2023 sound like nothing more than money woes: More than three in five (62%) Americans say they achieved financial goals they set out to reach in 2023. Financial headwinds are always present in one form or another. Preparing for them and learning from mistakes may set you up for a greater chance of success in the near future.

Full survey methodology available in the original article, published at NerdWallet.

This article was written by Elizabeth Renter for NerdWallet.